Examine beta coefficients to quantify how individual assets move relative to the broader market. Identifying consistent positive or negative betas reveals tokens that amplify or dampen market volatility. This insight enables portfolio adjustments targeting desired exposure levels and risk profiles.

Explore alpha generation potential by isolating tokens exhibiting returns unexplained by general market movement. Such anomalies often indicate inefficiencies or emerging trends, providing opportunities for strategic positioning beyond passive benchmarks. Systematic evaluation of these excess returns enhances selection criteria in dynamic environments.

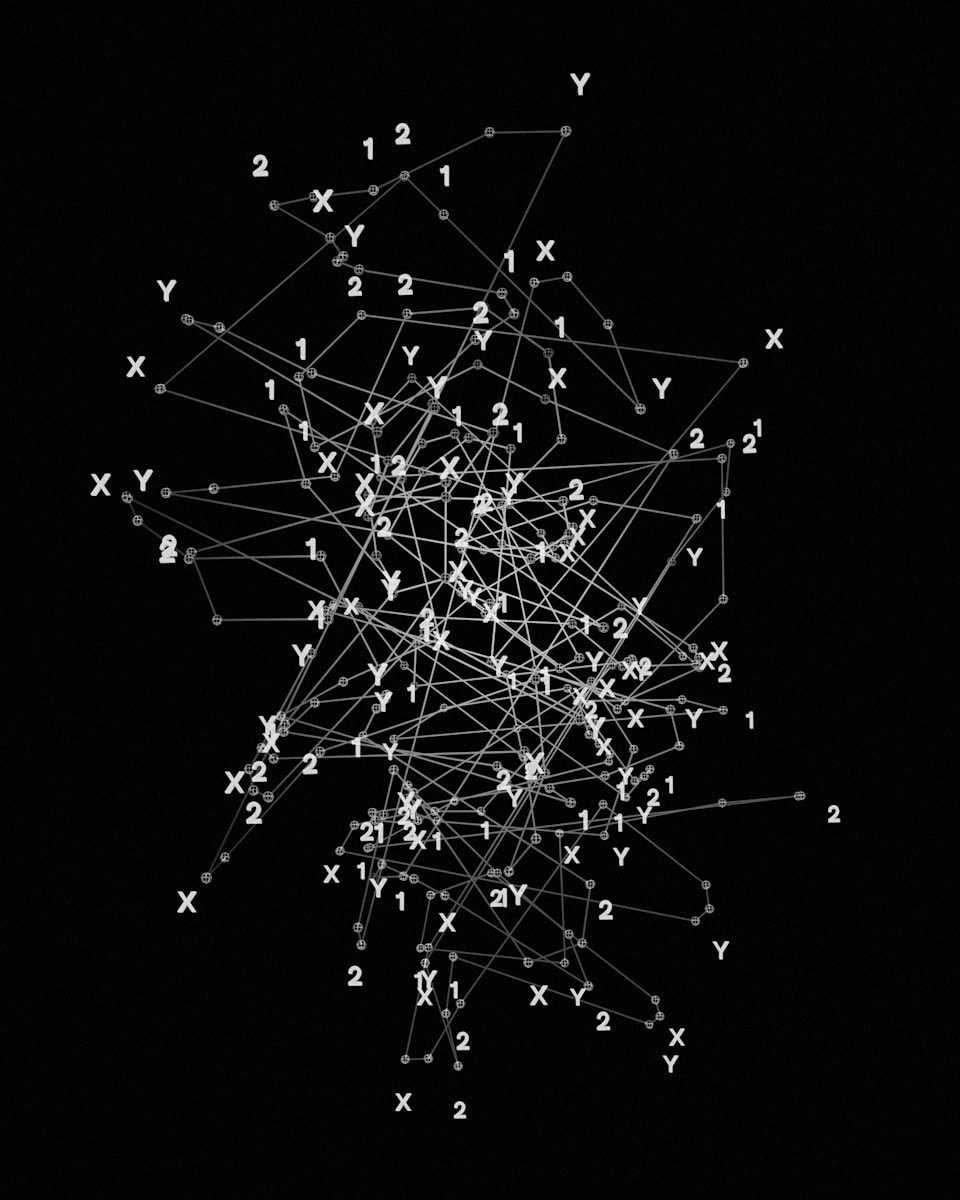

Utilize cross-asset covariance matrices to detect clusters with synchronous fluctuations. Mapping these interdependencies supports diversification strategies by revealing latent factors driving joint behavior. Experimental segmentation based on temporal data slices can uncover regime shifts impacting correlations over different time horizons.

Implement rolling-window methodologies to track evolving linkages between digital assets and traditional indices. This approach assists in anticipating contagion effects during periods of stress or exuberance, thereby informing timely hedging tactics. Applying statistical rigor ensures robustness against spurious associations within noisy datasets.

Correlation studies: token relationship analysis

For accurate assessment of market dynamics, evaluating the co-movement between digital assets provides actionable insights into portfolio diversification and risk management. Calculating beta coefficients against benchmark indices reveals how individual tokens respond to systemic shifts, distinguishing between idiosyncratic and market-driven fluctuations.

Alpha generation potential emerges from understanding interdependencies among assets. By quantifying statistical dependencies using advanced metrics beyond simple correlation coefficients, one can isolate non-linear interactions and lagged effects that traditional methods often overlook. This approach enhances predictive modeling for trading strategies.

Examining market movement through statistical metrics

The synchronous movement of cryptographic coins often reflects shared exposure to macroeconomic factors or protocol-specific news. Employing rolling-window analysis allows observation of temporal changes in association strength, highlighting periods where coupling intensifies or weakens. For example, during major network upgrades, certain tokens demonstrate heightened synchronization with governance-focused assets.

Beta values calculated via regression against a comprehensive crypto market index provide a measure of relative volatility sensitivity. Tokens exhibiting beta above 1 tend to amplify broader market trends, implying higher systematic risk but also opportunities for outsized returns when combined with alpha-driven selection techniques.

- Stepwise calculation of covariance matrices across multiple timeframes elucidates evolving inter-asset dependencies.

- Utilization of principal component analysis (PCA) extracts dominant factors influencing collective price behavior.

- Dynamic conditional correlation (DCC) models capture real-time fluctuations in asset linkages under varying volatility regimes.

These quantitative tools enable dissecting complex networks of digital currencies to identify clusters sharing common drivers. Recognizing such groupings facilitates constructing hedged positions that mitigate undesired exposure while maintaining targeted return objectives.

Experimental investigation into alpha sources involves isolating residual returns unexplained by broad market movements or shared patterns among cohorts. Machine learning algorithms applied to feature sets including sentiment data, on-chain metrics, and liquidity measures can uncover subtle signals predictive of outperformance independent from beta influences.

The systematic exploration of connections between decentralized assets encourages deeper inquiry into causative mechanisms driving observed statistical associations. Controlled experimentation involving event studies–such as protocol forks or regulatory announcements–permits validation of hypotheses regarding information transmission pathways in blockchain ecosystems.

This progressive methodology nurtures critical thinking about interplay among financial instruments coded on distributed ledgers, fostering an empirical mindset essential for innovation in cryptocurrency research and strategic asset management design.

Selecting Variables for Correlation in Token Market Movements

Accurate identification of variables that influence the alpha and beta of digital assets is fundamental to meaningful statistical examination. Start with clearly defined market indicators such as trading volume, price volatility, and network activity metrics, since these often exhibit quantifiable dependencies. Incorporating variables that capture on-chain data alongside traditional financial measures improves robustness when assessing co-movements between assets.

The choice of explanatory factors should prioritize those with demonstrated predictive power or theoretical justification rooted in blockchain mechanics. For example, gas fees may reflect network congestion impacting token liquidity, thereby affecting short-term price trends. By systematically including both macroeconomic indices and protocol-specific parameters, one can better isolate genuine interdependencies amidst noisy datasets.

Key Considerations for Variable Selection

1. Statistical Significance and Data Quality: Variables must provide consistent signals over varied timeframes to avoid spurious connections. Employ rigorous filtering techniques to exclude outliers and incomplete records from feeds like exchange order books or decentralized oracle reports.

2. Beta Sensitivity Analysis: Understanding an asset’s beta relative to a benchmark index informs which external drivers are relevant. Assets with high beta values respond strongly to market-wide shocks, suggesting broader economic indicators as candidate inputs.

- Case Study: Analysis of Ethereum’s price fluctuations showed stronger correlation coefficients with smart contract deployment rates than with raw transaction counts during bullish phases.

- Example: Stablecoins exhibit near-zero beta concerning volatile tokens but correlate more tightly with fiat currency indices, guiding variable prioritization accordingly.

3. Temporal Alignment and Lag Effects: Examine lead-lag relationships by shifting variables across multiple intervals; this reveals causality directions rather than mere synchronous movement patterns. For instance, changes in staking participation might precede price adjustments by several days.

Selecting variables requires iterative experimentation combined with domain insights to refine models reflecting authentic interplays rather than coincidental associations. Encourage constructing testable hypotheses about why certain metrics should impact returns before computational validation using tools like Pearson or Spearman coefficients alongside regression diagnostics.

This investigative approach transforms quantitative assessment into a scientific endeavor where each variable represents a controlled experimental condition within the complex ecosystem of decentralized finance markets. Such rigor fosters deeper comprehension of underlying mechanisms driving token dynamics beyond superficial numerical correlations.

Applying Statistical Methods Correctly

Accurate measurement of alpha in asset returns requires stringent adherence to statistical protocols, particularly when evaluating interdependencies among various cryptocurrencies. Employing Pearson’s coefficient without confirming linearity or homoscedasticity may yield misleading interpretations of association strength. Instead, initiating with exploratory data visualization–scatterplots and residual analysis–facilitates identification of appropriate models to capture co-movements within the market.

The temporal dimension significantly affects the detection of meaningful connections between different blockchain-based assets. Utilizing rolling-window computations or dynamic time warping enhances sensitivity to transient synchronizations or lagged patterns in price fluctuations. For instance, applying Granger causality tests on intraday datasets can uncover directional influences that static measures overlook, refining predictive modeling and portfolio optimization strategies.

Refined Techniques for Quantitative Asset Interaction

Multivariate regression frameworks incorporating control variables such as volatility indices and trading volume improve robustness by isolating genuine inter-asset dependencies from confounding market factors. Bayesian hierarchical models provide probabilistic estimates for parameter uncertainty, enabling nuanced interpretation beyond binary significance thresholds. A notable application involved assessing Ethereum’s movement impact on emerging altcoins during high-volatility periods, revealing conditional correlations modulated by liquidity constraints.

Complementary approaches like principal component analysis (PCA) reduce dimensionality while preserving variance structure across numerous decentralized currencies, facilitating detection of latent common drivers influencing price trajectories. Experimental integration of machine learning algorithms–random forests and support vector machines–with traditional econometric techniques has demonstrated enhanced capacity to forecast shifts in alpha generation potential under diverse macroeconomic scenarios, encouraging iterative refinement through controlled empirical trials.

Interpreting Correlation Coefficients

Understanding the degree of association between two digital assets requires precise evaluation of their numerical linkage. The coefficient quantifies how the price movement of one asset corresponds with another, ranging from -1 to +1. Values near +1 indicate synchronous upward or downward trends, while those near -1 reveal inverse dynamics. Zero or near-zero values imply independence in their market behaviors.

When examining these coefficients within decentralized ecosystems, it is essential to consider various temporal windows and external factors that might influence simultaneous fluctuations. A high positive value during a bullish phase may diminish in bearish conditions, reflecting shifts in investor sentiment or liquidity constraints. Careful segmentation by timeframes enhances the resolution of such observations.

Beta and Volatility Considerations

The beta metric complements coefficient assessments by measuring an asset’s sensitivity relative to broader market indices or specific reference points. An asset exhibiting a beta greater than 1 indicates amplified volatility compared to its benchmark, which often correlates with stronger co-movements when paired with related tokens. However, a low beta coupled with a strong coefficient suggests stable but directionally aligned behavior.

Laboratory-style experiments involving rolling-window calculations can reveal evolving dependencies over time, offering insights into transient coupling versus persistent linkages. For example, evaluating daily returns over successive 30-day periods unveils phases where interconnectedness intensifies due to macroeconomic news or protocol upgrades affecting multiple assets simultaneously.

- Positive coefficients combined with elevated beta values signal heightened systematic risk exposure;

- Negative coefficients paired with moderate beta suggest hedging potential within portfolios;

- Near-zero coefficients often reflect diversification benefits but require verification across different conditions.

The experimental approach encourages testing different pairs under varying market regimes–bullish rallies, corrections, and sideways movements–to observe stability or fluctuation in connectivity metrics. Tracking these patterns helps decode whether observed associations stem from fundamental protocol alignments or ephemeral speculative trends.

A practical investigation involves selecting sets of decentralized assets associated with similar use cases (e.g., DeFi lending platforms) and computing contemporaneous coefficient matrices alongside rolling betas against major benchmarks like Ethereum or Bitcoin indices. This method fosters understanding of structural interdependencies versus noise-driven correlations emerging from short-term trading activity.

Conclusion: Harnessing Statistical Dependencies in Token Investment Approaches

Prioritizing beta sensitivity metrics alongside inter-asset covariation unveils nuanced insights into market flux, enabling more precise alpha generation. Quantifying how one asset’s price movement statistically aligns with others helps isolate systemic versus idiosyncratic drivers, refining portfolio construction and tactical rebalancing.

For example, identifying clusters of tokens exhibiting synchronized trajectories during volatility spikes can guide risk mitigation strategies by diversifying away from highly coupled units. Conversely, exploiting weakly linked or negatively associated assets may amplify returns through strategic hedging or momentum capture.

Future Directions and Practical Recommendations

- Dynamic beta modeling: Incorporate time-varying factor loadings to reflect evolving market regimes, capturing transient coupling shifts that static correlation matrices miss.

- Multivariate dependency frameworks: Employ copula-based or machine learning-driven dependence structures to detect nonlinear statistical ties among token sets beyond linear associations.

- Scenario-based stress testing: Simulate shock propagation across interconnected tokens to anticipate cascading effects and identify hidden contagion pathways.

- Integrated signal synthesis: Combine movement synchrony measures with on-chain activity and fundamental indicators for a holistic predictive edge.

The interplay between systematic factors and individual asset dynamics remains a fertile ground for exploration. By treating the statistical linkage patterns as experimental hypotheses rather than fixed truths, researchers and practitioners can iteratively refine models that adapt to shifting blockchain ecosystems and emergent market behaviors. This approach invites deeper inquiry into the genesis of co-movements, stimulating innovations in algorithmic trading strategies that harness both stability and disruption within decentralized finance environments.